Stop Renting Attention

The case for intentionally investing in connected customer relationships.

Every year, you spend more to reach and reconnect with the same people.

Customer acquisition costs have increased 60% over the past five years (Genesys). Google's cost-per-click jumped 10% in 2024 alone, five times the increase from the year before (Wordstream). Your organic reach continues its long decline. Your engagement rates are falling. You're running faster to stay in place.

This is the treadmill of mass-market acquisition: every impression is a transaction that resets to zero. You pay for reach, you get a momentary glimpse, you start over tomorrow. The platform takes its cut. The algorithm changes. Your “audience” evaporates.

Meanwhile, something else is happening in the margins of your business. In customer advisory boards. In user groups and partner networks. In the Slack channels, WhatsApp groups, and private communities where your most engaged customers actually spend their time. Relationships are quietly compounding. People who trust you are introducing you to people who don’t. Yet.

One of these is a treadmill. The other is an investment.

The Social Depreciation Problem

The economics of mass social acquisition have fundamentally broken.

In my previous piece, The Last Days of Social Media, I documented the engagement collapse across major platforms: Facebook’s 0.06% engagement rate despite three billion users, Twitter/X’s decline to 0.029%, and Instagram’s 28% year-over-year drop. In mass social the engagement problem is really an economics problem. You’re paying more for less, and the less keeps getting smaller.

Consider what’s changed in the past five years. Customer acquisition costs have risen across nearly every industry. Digital advertising costs continue climbing as competition intensifies and privacy regulations limit targeting precision. The platforms that once offered organic reach have systematically eliminated it, converting what was once free distribution into paid media with declining returns.

This creates a structural disadvantage. Every dollar you spend on mass acquisition buys diminishing results. Every “audience” you build exists at the pleasure of the platform, subject to algorithmic changes you can’t predict or control. Every campaign starts from zero because impressions don’t compound. They decay.

The mass social economy runs on extraction. Your attention is monetized. Your engagement is harvested. Your relationships are converted into targeting data, which is then sold back to you at higher prices.

The Compounding Alternative

Relationship equity works differently.

When someone trusts you because of positive, consistent interactions over time, that trust becomes an appreciating asset. It reduces friction in every subsequent interaction. It increases willingness to pay. It generates referrals that bring in people who arrive already predisposed to trust you.

The research here is remarkably consistent.

Customers acquired through relationships and referrals are worth significantly more than those acquired through paid channels. A landmark study by Wharton researchers tracking 10,000 bank customers over six years found that referred customers remained more valuable throughout the relationship, with approximately 16% higher lifetime value than comparable non-referred customers. They were more profitable and more loyal, and the difference persisted over time.

Then there is the classic finding from Frederick Reichheld’s research at Bain in the 1990’s that a 5% improvement in customer retention can drive profit increases of 25% to 95%. Not because retention is cheaper than acquisition (though it is), but because retained relationships compound in ways that new acquisitions cannot.

Here’s what compounding looks like in practice:

Depth. The longer you know someone, the more context you share. You understand their situation, challenges, and needs. They understand your capabilities. Every interaction builds on previous interactions rather than starting fresh. Cost-to-serve drops as customer knowledge and shared trust accumulate.

Breadth. Trusted relationships generate new relationships. People recommend businesses to people they know and trust. Research consistently shows that referred customers convert faster, cost less to acquire, and demonstrate higher loyalty. Referral-based acquisition costs a fraction of paid channels, often $150 compared to $800 or more for paid search in B2B contexts.

Resilience. Relationships survive competitive pressure. Eight in ten consumers say they’ll stick with a brand they trust even when another brand becomes “hot and trendy.” They’ll pay more. They’ll forgive mistakes. They’ll advocate on your behalf. This is the opposite of the algorithmic economy, where every interaction is a fresh evaluation and switching costs approach zero.

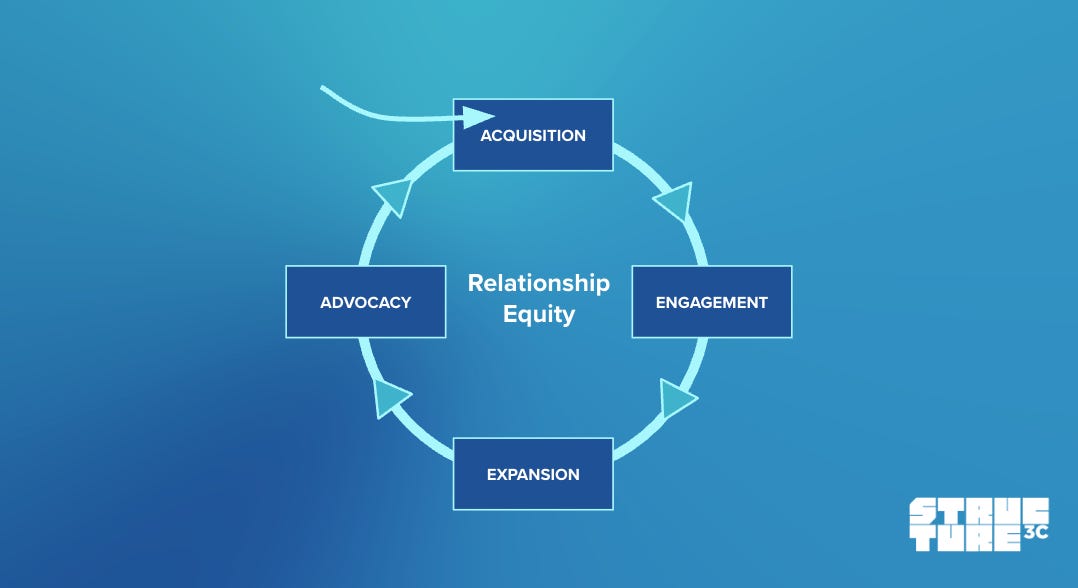

Relationship Equity Compounds Across the Customer Lifecycle

Executives often (and unfortunately) file "relationship strategy" under customer success, somewhere between onboarding and churn prevention. That's a fraction of the value. Relationship equity transforms how you acquire customers, engage them, expand accounts, and ultimately, grow your market share.

Acquisition: Your best customers become your most valuable growth channel. When referral-based CAC runs five to six times lower than paid acquisition, the math reshapes everything. You’re not just saving money. You’re acquiring customers who arrive with built-in trust, shorter sales cycles, and higher lifetime value. The community ecosystem generates growth that paid media cannot replicate.

Engagement: Connected customers don’t just consume. They contribute. They help each other succeed. They generate insights you couldn’t buy through research. They stress-test your assumptions and surface problems before they become crises. McKinsey research shows that 84% of Gen Z consumers trust product reviews from niche online communities more than corporate advertising. The ecosystem creates value that the organization alone cannot.

Expansion. Trust is the foundation of growth within accounts. Upselling and cross-selling happen because of relationships. When someone trusts you, they tell their coworkers and peers. Purchase decision makers are willing to extend that trust to adjacent offerings. When they don’t trust you, every new conversation starts from scratch.

Advocacy. Connected customers recruit. Three-quarters of consumers say they'll recommend a brand they trust when asked. Every recommendation has the potential to generate new customer relationships. Paid reach resets to zero each morning. Advocacy accumulates.

Executives often frame acquisition and retention as competing budget lines. Relationship equity makes the question irrelevant. Your ecosystem acquires and retains simultaneously.

The AI Inflection

Two converging forces make relationship equity more valuable than ever.

First, content is becoming commoditized. Every organization can now generate infinite content. The marginal cost of producing another blog post, another social update, another email sequence is nearly zero. What was once a competitive advantage, the ability to consistently produce and distribute content, has become table stakes.

When everyone can produce infinite content, attention fragments across endless options. The scarce resource becomes the trusted voice that helps you filter what matters.

This is where I want to introduce a concept I’m calling relational trust. The idea goes beyond someone trusting you in this moment. It’s that they trust you because of accumulated experience over time: shared context, demonstrated reliability, history that cannot be manufactured or accelerated.

AI can produce content. It cannot produce relational trust. An algorithm can optimize for engagement. It cannot replicate the relationships you’ve built through years of consistent interaction. A competitor can copy your messaging. They cannot copy your ecosystem.

Second, first-party relationships are becoming first-party data. Third-party cookies are dying. Privacy regulations are tightening. The organizations with direct, trusted relationships with their customers hold an asset that cannot be replicated by competitors or regulated away.

The value of relationship infrastructure extends beyond engagement to intelligence. When you have direct relationships with your ecosystem, you understand your market in ways that surveillance-based analytics can never match. You hear concerns before they become complaints, spot trends before they hit the broader market, and know what your customers actually think because they tell you.

Your “network of relationships” is a strategic asset that appreciates over time. And unlike reach or impressions, it cannot be taken away by an algorithm update or a platform policy change.

From Audiences to Ecosystems

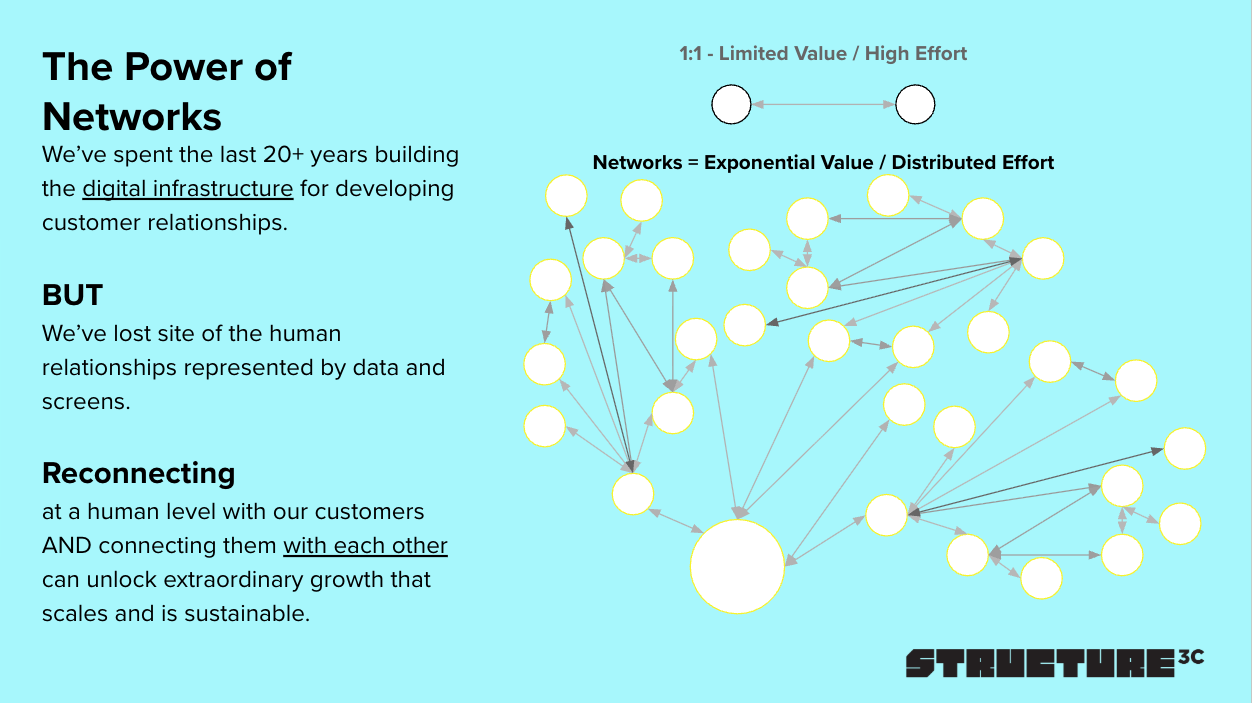

The mindset shift I’m advocating is in how senior leaders think about growth.

Mass social media trained us to think about digital networks in terms of audiences: passive recipients of one-to-many communication, counted by reach and impressions. The relationship-first model brings us back to the more meaningful opportunity: interconnected networks where communities form and value flows in multiple directions.

Audiences are rented. Ecosystems are hosted (and owned). When you build an audience on a social platform, you don’t own the relationship. The platform does. They can change the rules, limit your reach, or shut you down entirely. And keep in mind, these are often customer relationships you already have access to. When you build an ecosystem of direct relationships, that infrastructure belongs to you.

Audiences decay. Ecosystems compound. Every social media impression starts fresh. Every relationship builds on what came before. The difference is between a transaction and an investment.

Audiences are measured by reach. Ecosystems are measured by connection. The metrics that matter aren’t how many people saw your content. They’re the density of relationships within your network, the velocity of referrals, the depth of trust that enables everything else.

This doesn’t mean abandoning all mass-market activity. It means recognizing that mass-media activity should feed ecosystem development. Use reach to attract. Use relationships to retain, grow, and generate the next wave of attraction.

The Compound Interest of Connection

The organizations that thrive in the next decade won’t be the ones with the biggest audiences. They’ll be the ones with the most robust relationship networks: ecosystems where relational trust compounds, where customers become advocates, where every connection has the potential to generate the next one.

You can keep renting attention on platforms that take more and give less every year. Or you can start building the relationship infrastructure that appreciates over time.

Every customer interaction is either a transaction or an investment in a more connected relationship. One resets to zero. The other compounds.

Fantastic article. Thank you for this. Had lunch with a friend and we were talking about this… not as in depth, not with such discernment. You’ve added to our conversation. Thank you! 🎉

Great read! Thank you.